How much insurance for car in 2022, what is Car Insurance, types of Insurance for car, 5 Benefits of Insurance for car how much insurance for car,...

|

| How much insurance for car in 2022 |

How much insurance for car in 2022 | digitalskillsguide.com

How much insurance for car in 2022

How much insurance for car in 2022

How much insurance for car depends on what coverages you need, where you live and your driving history.

How much insurance for car depends on what coverages you need, where you live and your driving history.

In this article we are going to find out details about how much insurance for car you might need, how much it cost and everything on car insurance.

Car insurance is an important part of owning a vehicle. It protects against financial loss due to accidents and other events that could cause damage to your vehicle.

Different types of insurance policies offer varying levels of protection.

Stay with me and let's analyse the types of car insurance and how much insurance for car is out there so you can benefit from the knowledge and get yourself insured.

Below is detailed information on How much insurance for car in 2022.

How much insurance for car in 2022 Table of Contents

1. What is Car Insurance?

2. Types of Insurance for car

3. 5 Benefits of Insurance for car

4. How much insurance for car

5. How much insurance for car in different states

6. How much insurance for car each month?

7. How much insurance for car each month?

8. Calculate how much auto insurance you need

10. More factors that can affect how much your car insurance costs

11. Important factors to consider while choosing car insurance

12. How much insurance for car Frequently asked questions

12.1 How much is insurance for car per month?

12.2 How much cheaper is minimum insurance compared to full coverage insurance?

12.3 Who pays the most for insurance for car?

12.4 What's the average cost of insurance for car per month?

12.5 What is the cheapest car insurer?

12.6 How much more expensive is full coverage car insurance?

Conclusion

How much insurance for car in 2022

1. What is Car Insurance?

Vehicle insurance (also known as car insurance, motor insurance, insurance for car or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.

Car insurance can help protect you from costs related to auto accidents and other types of losses, such as the theft of your car. A car insurance policy helps you keep yourself financially secured against the own-damage expenses of your car.

Typically, insurance for car covers the car. So, if someone else drives your car and gets into an accident, your insurance company helps cover the claims.

Car insurance gives you financial protection in the event of an accident. And some types also cover claims arising from injuries to other people

Insurance for car is designed to protect you against financial losses if you're involved in an accident or the vehicle is damaged in some way.

2. Types of Insurance for car

|

| How much insurance for car in 2022 |

Learn about the different types of coverage available and what they cover

1. Comprehensive Coverage

Comprehensive coverage covers everything except collision damage. This includes liability coverage, medical payments, property damage, and uninsured motorist coverage. Collision coverage only covers damage caused by collisions with another object.

2. Collision insurance

Collision insurance is a type of car insurance that pays out if the insured's car is damaged in an accident because of the insured driver's negligence. Adding collision coverage to a standard vehicle insurance policy is a common practice to safeguard policyholders against financial ruin in the case of an accident.

READ THIS ONE: All state farm commercials Male and Female Actors

3. Liability Coverage

Comprehensive liability insurance covers damage caused by your car. Collision coverage protects you against damage to other vehicles or property when you cause an accident.

3. Medical Payments Coverage

If you are involved in an accident with another driver who has medical payments coverage, you will be responsible for paying any medical bills incurred as a result of the accident. This type of coverage is often included in your comprehensive policy.

4. Uninsured Motorist Coverage

You also need uninsured motorist (UM) coverage. UM coverage pays for injuries caused by drivers without liability insurance. It covers you when you are injured by a driver who does not have enough liability insurance to pay for damages.

How much insurance for car in 2022

3. 5 Benefits of Insurance for car

As per Motor Vehicle Act, a Third Party insurance is compulsory and you must purchase one whether you buy a new or a used vehicle. You may purchase a comprehensive cover as well.

The former type of insurance protects you against financial and legal liabilities towards a third party. On the other hand, A comprehensive insurance policy provides cover to your vehicle against damage due to accident, fire, theft, cyclone, flood etc. Along with this cover, it covers any third party liability .Here are five major car insurance benefits.

|

| How much insurance for car in 2022 |

1. Damage or loss to insured vehicle

In case your vehicle is damaged due to an accident, fire, or self ignition, you are protected. Furthermore, if the car suffers losses due to burglary or theft, strikes, riots, or terrorism, your insurance policy covers these. Another benefit of car insurance is that it covers loss or damage while in transit by rail, inland waterways, air, road, or lift.

2. Personal accident cover

Another advantage of car insurance is that it offers personal accident cover for a pre-determined amount. Personal Accident cover provides protection against permanent total disability, Death due to an accident. Furthermore, this cover can be taken for other passengers on unnamed basis (maximum as per the vehicle’s seating capacity) for a pre-determined amount under the car insurance policy.

3. Large network of garages

This ensures you receive cashless services in all these locations, in case the need arises. This feature makes it convenient to avail of repair services in case of any damage to your vehicle.

4. Third party liabilities

If your car is involved in an accident that results in damage or loss to the property of any third parties, it is covered under the car insurance. Furthermore, if you face any legal liabilities in case of any bodily injury or death of a third party, your car insurance protects you against the same.

Read Also: What Is Full Coverage Car Insurance?

5. No claim bonus

One of the major advantages of having car insurance is the no claim bonus (NCB). Customer is eligible for this benefit for every claim-free year. This may be available as a discount on the premium, which makes car insurance even more affordable.

4. How much insurance for car

You may have questions regarding insurance providers, plans, and pricing when you begin your search for the best insurance company for you.

If you're shopping around for vehicle insurance, you might be curious about how much insurance for car can cost you. Understanding the aspects that might affect your vehicle insurance costs is important.

According to 2022 rate statistics, the average cost of full-coverage vehicle insurance is $1,771. Insurers use more than a dozen specific rating elements to calculate rates, so each driver's rate will be different.

How much insurance for car in 2022

5. How much insurance for car in different states

There are different rules and criteria for automobile insurance in each state. The cost of car insurance might be affected by the driving conditions in various states.

So, if you are wondering how much insurance for car in different states, then the answer is each states have their own rules.

6. How much insurance for car each month?

How much insurance for ca

|

| How much insurance for car in 2022 |

7. How much insurance for car each month?

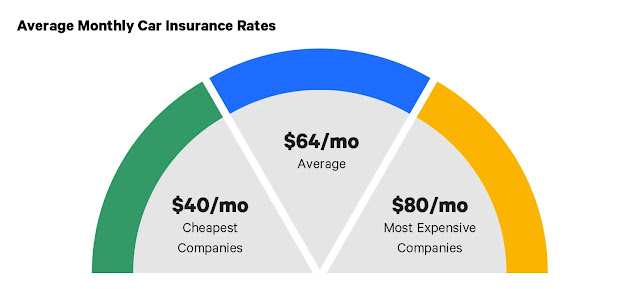

As a general rule, car insurance costs between $110 and $130 a month, depending on criteria such as location, vehicle type and model, driving history, and other variables. Gender, marital status, and age all have a role in vehicle insurance rates. Optional coverages are also available from some insurance providers, which might raise the cost of your policy.

8. Calculate how much auto insurance you need

The bare minimum coverage needed by your state determines how much insurance for car you'll need. Personal injury protection (PIP) or uninsured motorist coverage (UIM) is not required by law in all states. We recommend starting with your state's minimal coverage requirements as a starting point. Then, to be sure you're adequately protected, look into increasing your coverage amounts and/or kinds.

How much insurance for car

9. What other factors can affect average car insurance costs?

|

| How much insurance for car in 2022 |

We've discussed how the following factors have the biggest impact on your car insurance premiums:

- Company

- State

- Policy coverage

- Age

- Vehicle type

- Accident and credit history

10. More factors that can affect how much your car insurance costs

- Driving experience

- Address and ZIP code

- Insurance and claims history

- Annual mileage

- Discounts

1. Driving experience: Age affects your car insurance cost, but so does the number of years you've been insured and driving. A 30-year-old who's had an insurance policy and been licensed since you were 16 should get cheaper car insurance prices than a 30-year-old who just took up driving.

2. Location within a state: Auto insurance is regulated differently in each state, leading to average prices for a full-coverage policy ranging from just under $1,200 (Maine) to over $7,000 (Michigan). But even within a state, insurers considered certain locations — or territories, in insurance terms — to be higher risk.

If you live in an area that's considered to be higher risk due to car crashes, weather or crime, you may be subject to a higher rate than an equivalent driver living elsewhere.

3. Insurance history: If you've maintained continuous auto insurance coverage, your insurer will be more confident that you've protected yourself and will usually charge a lower rate.

Claims history: You'll get cheaper rates than someone who has filed auto insurance claims in the past.

4. Mileage: Cars that are driven less frequently are less likely to be involved in a crash or other damaging event. Vehicles with lower annual mileage may qualify for slightly lower rates.

5. Discounts: Auto insurance companies offer a variety of discounts for those who take steps to become safer drivers or demonstrate responsible behavior. For example, adults can take defensive driving lessons, while young adults can qualify for good student discounts.

11. Important factors to consider while choosing car insurance

Here are two factors you must consider while choosing a car insurance amongst various insurers.

1. Quick and hassle-free process

When you choose to buy a car insurance policy, it is important that you do not have to undergo a long and cumbersome procedure. The entire process must be simple, quick, and convenient. Furthermore, choosing an insurer that offers the additional convenience of purchasing the policy online is recommended.

2. Customer support

A reliable and reputed insurance company hires trained and experienced personnel to help resolve all your queries. Insurance companies also offer live chats to ensure your issues are resolved without any delays.

12. How much insurance for car Frequently asked questions

12.1 How much is insurance for car per month?

Car insurance costs $136 per month on average, according to NerdWallet’s rates analysis. However, your rate will vary depending on factors such as where you live, the vehicle you drive and your driving history. Compare car insurance rates to find the cheapest car insurance for you.

12.2 How much cheaper is minimum insurance compared to full coverage insurance?

On average, full coverage insurance costs about $136 a month compared to $47 a month for minimum coverage. However, unlike minimum coverage, full coverage insurance pays out if your car is stolen or you need repairs after an accident. Minimum insurance covers damages to another person or vehicle only in an at-fault accident. It does not cover your own repairs or injuries.

12.3 Who pays the most for insurance for car?

It’s hard to say exactly who pays the most for car insurance since there are so many factors that affect your auto insurance rates. In general, teen drivers, drivers with a recent DUI and drivers with poor credit pay some of the highest car insurance rates on average

12.4 What's the average cost of insurance for car per month?

The national average cost of insurance is $65 per month for minimum coverage, or $785 per year. Your rate will vary based on where you live, what kind of coverage you have and your driving history.

12.5 What is the cheapest car insurer?

The cheapest major insurers are State Farm, Farm Bureau and USAA. USAA tends to have the best prices, but it's only available to people who have served in the military and their families. State Farm and Farm Bureau are more widely available and also have affordable rates.

12.6 How much more expensive is full coverage car insurance?

Depending on your car and driving history, full coverage insurance is typically about twice as expensive as liability-only coverage. This includes collision coverage, which pays for damage to your car in a crash, and comprehensive coverage, which covers other forms of damage like hail.

Conclusion

How much insurance for car is an important thing to consider when choosing a provider. Of course, you’ll also want to pick a reputable insurer that offers good coverage and has a simple claims process.

Hope you've gained something concerning car insurance from this article on How much insurance for car in 2022.